There’s a New Chip Card Scam to Watch for.

It looks like there is a new chip card scam to watch for. Last week, Brian Krebs reported that the US Secret Service started notifying banks of this new scheme. Although credit card companies usually claim that criminals can’t crack chip cards, crooks found a way. It requires access to the card but is relatively simple.

So, what is the new chip card scam?

Essentially, crooks get a hold of the card on the way to the customer. With physical access to the chip card, they heat the chip to remove it from the card. Next, the criminals replace the chip with one from an unusable card to make it look genuine. Finally, they send it on its way to the customer.

The criminals then wait. It seems they lack the information to actually activate the card, so they wait for the customer to do so. The customer, unaware that criminals tampered with the card, activates it, and is unaware that the card will not work.

This gives the thief a limited amount of time to use the card, but when the customer activates it, the criminal has a working card. At this point they can use it as much as they like, assuming the card doesn’t require a pin code.

Who is this scam targeting?

Currently, the scam is mostly targeting businesses, and mostly ones with big accounts. But schemes like this often start with high value targets and end up hitting others, so it is important to take note of this new chip card scam early.

Crooks get the cards somewhere before they get to the customer. This could be from USPS workers gone rogue or even someone sneaking access to the mailbox before the customer gets the card. Either way there are signs to look out for.

So how do you know if you are a victim of this new chip card scam?

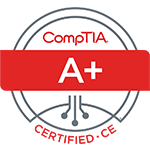

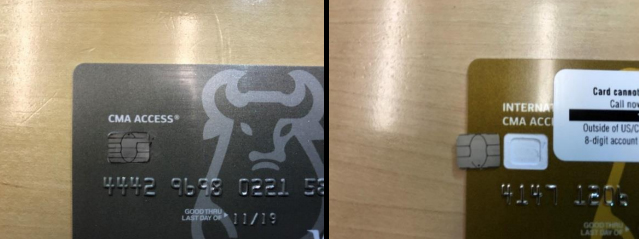

Thankfully, the criminals often damage the card when they heat the it to remove the chip. Look for signs of burning, melted plastic, and even discoloration. Sometimes the chips in the card have noticeable bends in them, so check for chip damage too.

Another sign you should check for is a misfitting chip. Cards often have different sizes of chips, even from the same makers. So if a chip seems too big or too small for your card, it may be a sign of tampering.

Finally, check of any holes in the plastic of the card. Sometimes the criminals will make a small pin hole in the plastic part to pry the chip off cleanly. So damage such as this is a good sign that criminals altered the card.

What should I do if I suspect tampering?

Contact your bank right away if the card looks suspicious, and do not activate it. Once you active the card, the criminals have access to the funds, so make sure not to do this. Your bank will often share details with the FBI or Secret Service if necessary.

If you need a second opinion or just want more help on what you need to look out for, you can also feel free to contact us. As cyber security professionals, we are more than happy to help you avoid this new chip card scam.